Sean Gallup

E-commerce platform Shopify Inc. (NYSE:SHOP) reported record sales for Black Friday over the weekend, which saw revenues of $3.36B, showing an increase of 17% year-over-year. Shopify also reported solid third-quarter results last month that saw a continual expansion of core products such as Shopify Capital, and the e-Commerce company benefited from continual momentum in Subscriptions as well as Merchant Solutions. Given the momentum in Shopify’s core business and growing platform value for merchants, I continue to see Shopify as one of the best e-Commerce stocks available to investors!

Strong Q3 2022 results

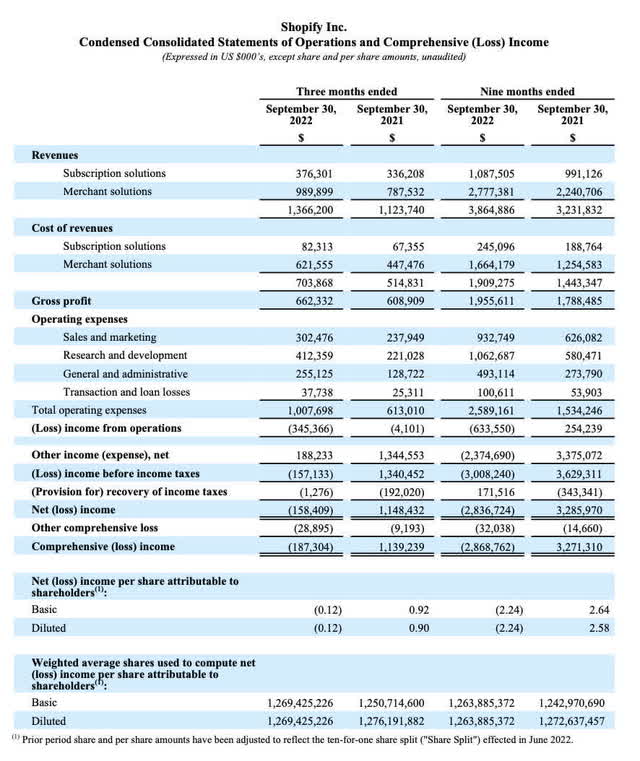

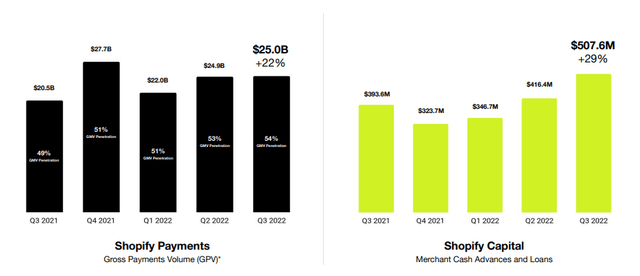

Shopify reported $1.37B in revenues for the third-quarter, showing 22% year over year revenue growth. Subscription revenues, which include revenues from the sale of Shopify’s monthly subscription plans, totaled $376.3M, showing 12% year-over-year growth. The real momentum, however, is with Merchant Solutions, where revenues soared at more than twice the rate, 26% year-over-year, to $989.90M. Merchant Solutions is seeing momentum because merchants selling their merchandise through Shopify’s online stores are rapidly adopting services like Shopify Capital, Shopify Shipping, or Shopify Pay Installments, which are all services that complement the firm’s subscription plans.

In the third-quarter, Shopify’s gross profit increased 9% year-over-year to $662.3M, but the e-Commerce firm continued to make a loss of $158.4M, or $0.12 per-share.

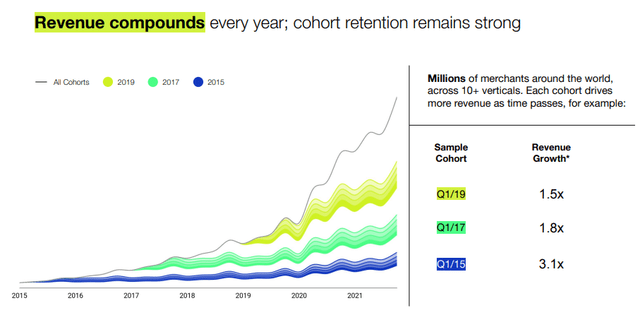

The key to Shopify’s success is that the company is digging deep into the e-Commerce value chain. Offering consumers monthly subscription plans is only the first step to building a successful partnership with its merchants. Shopify’s real value-add lies in the offering of products and services that help successful merchants grow their businesses over the long term. Examples include Shopify’s payment processing services or the provision of growth capital. By doing that, Shopify attaches itself to the growth and success of its merchants.

A good example is Shopify Capital, which is seeing record product uptake from Shopify’s merchant base. In Q3 2022, Shopify Capital supplied merchants with a record $507.6M in capital, showing 29% year over year growth. Since its inception in FY 2016, Shopify has supplied $4.3B in capital to its merchants (as of September 30, 2022).

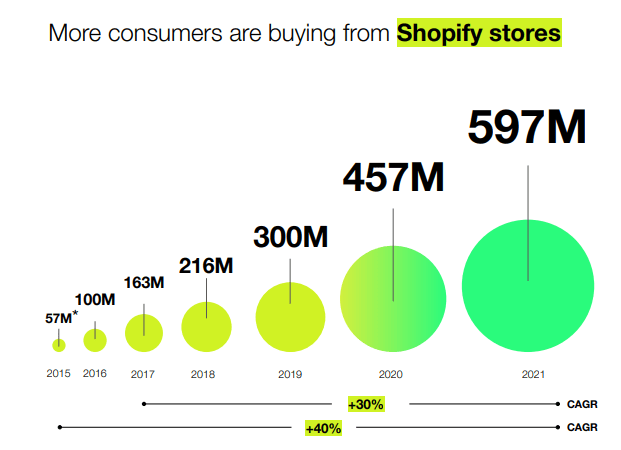

Shopify’s growing platform size and increasing density of its product offering has resulted not only in sustained growth of its merchant base, but also in a record number of shoppers that are buying from Shopify’s stores. The number of Shopify stores as well as the number of buyers from Shopify stores exploded higher during the pandemic, and although growth is slowing, Shopify has very attractive growth prospects in the coming years as it builds out its platform and adds new features. I am especially optimistic regarding the $2.1B acquisition of Deliverr, which adds fulfillment capabilities for Shopify’s merchants.

Source: Shopify

No other e-Commerce company than Shopify offers merchants the amount of tools to grow their online businesses. Due to core product uptake, merchant cohorts are spending significantly more money on Shopify’s products and services over time, which helps improve merchant monetization and long-term revenue growth.

Shopify’s valuation

Shopify has not submitted a specific revenue guidance for FY 2022 due to economic uncertainties and a post-pandemic slowdown in the retail industry. Shopify is expected to generate revenues of $5.5B in FY 2022 and $6.7B in FY 2023, implying top-line growth rates of 19% and 22%.

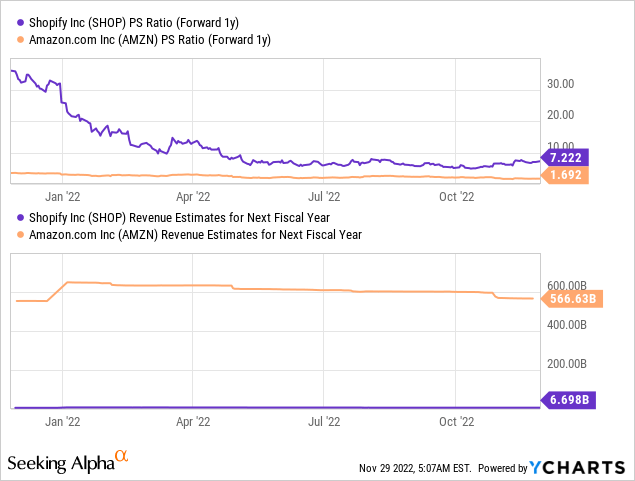

Based off of revenues, Shopify is currently valued at a P/S ratio of 7.2 X. Rival e-Commerce company Amazon (AMZN) is trading at much lower P/S ratio of 1.7 X, but this is likely because Shopify faces stronger prospects for near-term growth than Amazon.

Amazon’s top line, for example, is expected to grow only 11% next year, meaning Shopify is expected to grow its revenues twice as fast as Amazon in FY 2023. On the other hand, Shopify is not profitable, while Amazon at least generates some baseline level of profitability.

Risks with Shopify

The biggest commercial risk for Shopify, as I see it, is a slowdown in the company’s top-line growth. Specifically, a decline in subscription plan purchases as well as weaker adoption of core products such as Shopify Capital are risks for Shopify, partly because the e-Commerce platform is not yet profitable. I also see risks with inflation going forward, especially if it proves to be sticky, which could weigh on consumer spending and affect Shopify’s prospects for platform growth in FY 2023.

Final thoughts

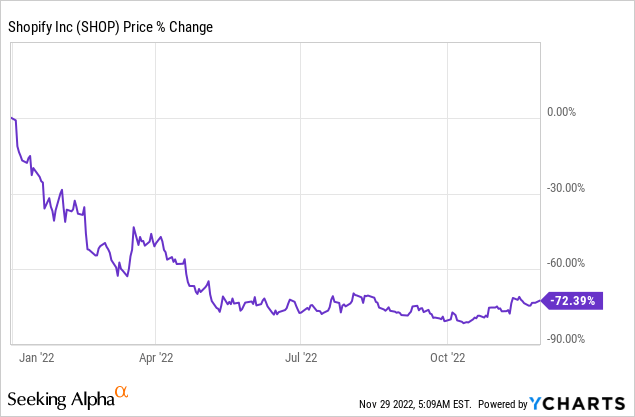

Despite a crushing draw-down of approximately 72% in 2022, I like Shopify’s expansion into new businesses that are providing the merchant base with new products and services such as Shopify Pay Installments, fulfillment services, and the temporary provision of growth capital. Although the market currently does not hold Shopify in high regard, I believe Shopify’s broad ecosystem and scale give the company a unique advantage in the e-Commerce industry. While shares of Shopify are not cheap based off of revenues, I believe the growth opportunity in the e-Commerce market justifies this valuation factor!

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)