Blue Planet Studio

A Quick Take On Klaviyo, Inc.

Klaviyo, Inc. (KVYO) has filed to raise $100 million in an IPO of its Series A common stock, according to an SEC S-1 registration statement.

The firm operates a software-as-a-service (“SaaS”) platform to help online marketers better communicate with customers and prospects.

Klaviyo, Inc. is growing top line revenue quickly, is producing net profits and plenty of free cash flow on efficient use of capital.

I’ll provide an update when we learn more about the IPO from management.

Klaviyo Overview

Boston, Massachusetts-based Klaviyo, Inc. was founded to develop a platform that combines data into a “vertically-integrated solution with advanced machine learning and artificial intelligence capabilities.”

Management is headed by co-founder, Chairman and CEO Andrew Bialecki, who has been with the firm since its inception in 2012 and was previously Chief Technology Officer at RockTech and Senior Engineer at Performable, a marketing software company.

The company operates a marketing automation platform focused primarily on small and medium-sized businesses in the retail and eCommerce industry segments.

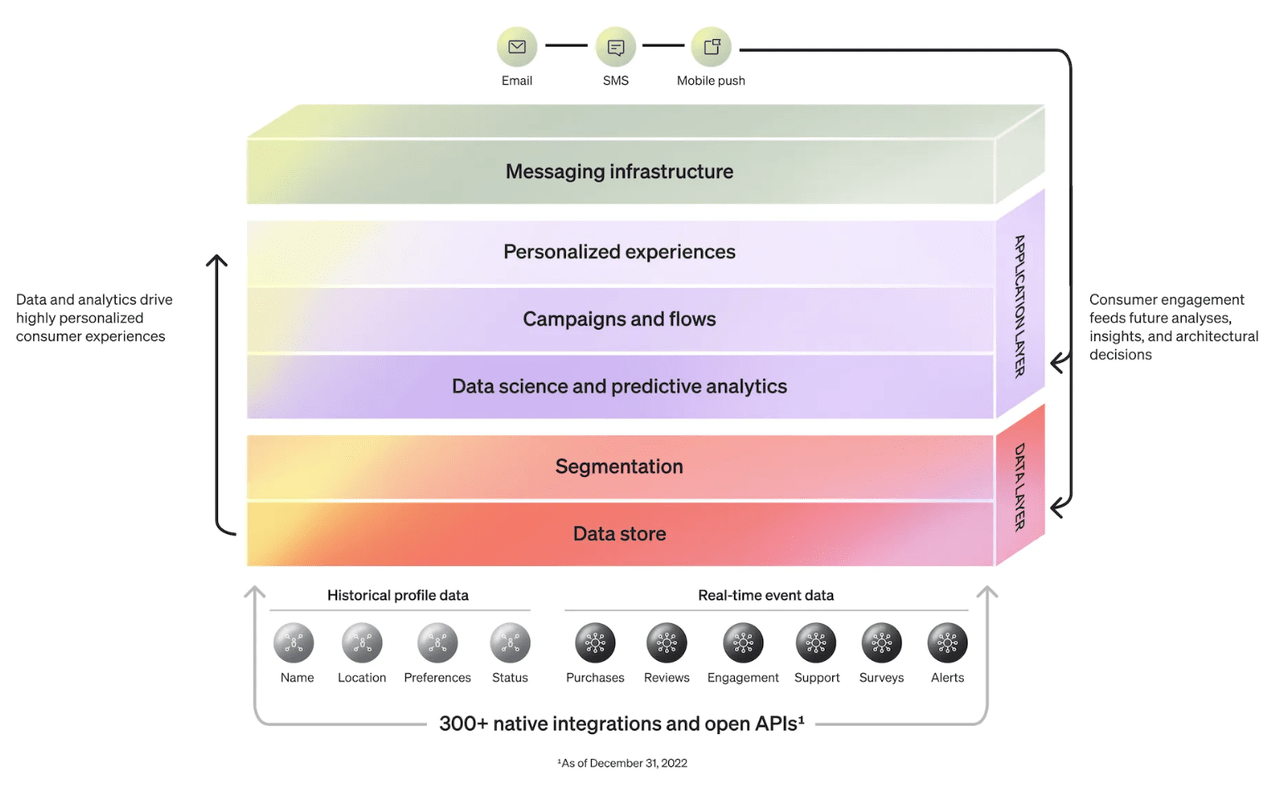

Below is a chart showing the company’s platform composed of the data layer (bottom two red-orange horizontal bars) and the application layer (top three purple horizontal bars).

Klaviyo Software Platform (SEC)

As of June 30, 2023, Klaviyo has raised $455 million in equity from investors, including Summit Partners, Shopify Strategic Holdings and Accomplice, but says it has used only $15 million of the investment in its business operations.

Klaviyo Customer Acquisition

The firm is prominently featured on the Shopify platform and generates strong inbound interest through Shopify and agency partners.

As of June 30, 2023, the company had over 130,000 customers worldwide.

Selling and Marketing expenses as a percentage of total revenue have trended materially lower as revenues have increased, as the figures below indicate:

|

Selling and Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2023 |

38.7% |

|

2022 |

49.0% |

|

2021 |

53.8% |

(Source – SEC.)

The Selling and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling and Marketing expense, increased to 0.9x in the most recent reporting period, as shown in the table below:

|

Selling and Marketing |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2023 |

0.9 |

|

2022 |

0.8 |

(Source – SEC.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

KVYO’s most recent calculation was 56% as of June 30, 2023, so the firm has performed extremely well in this regard, per the table below:

|

Rule of 40 |

Calculation |

|

Recent Rev. Growth % |

54% |

|

EBITDA % |

2% |

|

Total |

56% |

(Source – SEC.)

The firm’s dollar-based net revenue retention rate as of June 30, 2023, was 119%, a good result.

The dollar-based net revenue retention rate metric measures how much additional revenue is generated over time from each cohort of customers; a figure over 100% means that the company is generating more revenue from the same customer cohort over time, indicating good product/market fit and efficient sales and marketing efforts.

KVYO’s most recent average annual contract value was $5,100.

Klaviyo’s Market & Competition

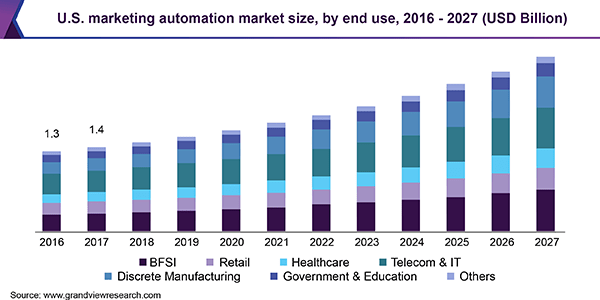

According to a 2020 market research report by Grand View Research, the global market for marketing automation was an estimated $4 billion in 2019 and is forecasted to reach $8.6 billion by the end of 2027.

This represents a forecast CAGR (Compound Annual Growth Rate) of 9.8% from 2020 to 2027.

The main drivers for this expected growth are continued digitalization of industries, growing internet usage and penetration and the demand for marketing automation to improve ROI results by companies.

Also, the chart below shows the historical and projected future growth trajectory of the U.S. marketing automation market by end-use through 2027:

U.S. Marketing Automation Market (Grand View Research)

Major competitive or other industry participants include the following:

-

Braze

-

ActiveCampaign

-

Iterable

-

Adobe

-

Salesforce

-

Oracle

-

Maropost

-

Others.

Klaviyo, Inc. Financial Performance

The company’s recent financial results can be summarized as follows:

-

Strong top line revenue growth

-

Increasing gross profit and gross margin percentage

-

A swing to positive operating profit

-

Substantial positive cash flow from operations.

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2023 |

$ 320,674,000 |

53.9% |

|

2022 |

$ 472,748,000 |

62.7% |

|

2021 |

$ 290,640,000 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2023 |

$ 246,624,000 |

64.1% |

|

2022 |

$ 344,723,000 |

67.4% |

|

2021 |

$ 205,944,000 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2023 |

76.91% |

4.8% |

|

2022 |

72.92% |

2.9% |

|

2021 |

70.86% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2023 |

$ 7,910,000 |

2.5% |

|

2022 |

$ (55,036,000) |

-11.6% |

|

2021 |

$ (79,233,000) |

-27.3% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2023 |

$ 15,165,000 |

4.7% |

|

2022 |

$ (49,193,000) |

-10.4% |

|

2021 |

$ 79,393,000 |

27.3% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2023 |

$ 57,026,000 |

|

|

2022 |

$ (23,552,000) |

|

|

2021 |

$ (22,738,000) |

|

(Source – SEC.)

As of June 30, 2023, Klaviyo had $439 million in cash and $147 million in total liabilities.

Free cash flow during the twelve months ending June 30, 2023, was an impressive $49.7 million.

Klaviyo’s IPO Details

Klaviyo intends to raise $100 million in gross proceeds from an IPO of its Series A common stock, although the final figure may differ.

Series A common stockholders will be entitled to one vote per share, and Series B common stockholders will be entitled to ten (10) votes per share.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says the firm qualifies as an ‘emerging growth company’ as defined by the 2012 JOBS Act and may elect to take advantage of reduced public company reporting requirements.

Management says it will use the net proceeds from the IPO as follows:

We currently intend to use the net proceeds that we will receive from this offering for working capital and other general corporate purposes and to fund our growth strategies discussed in this prospectus, including continued investments in our business globally. We may also use a portion of the net proceeds that we receive to acquire or invest in complementary businesses, products, services, technologies, or other assets.

(Source – SEC.)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is ‘not currently a party to any material pending legal proceedings.’

The listed bookrunners of the IPO are Goldman Sachs, Morgan Stanley, Citigroup and other investment banks.

Commentary About Klaviyo’s IPO

KVYO is seeking to go public to invest in its growth initiatives and provide a market for its shares.

The company’s financials have produced excellent topline revenue growth, growing gross profit and gross margin percentage, a swing to positive operating profit and material positive cash flow from operations.

Free cash flow for the twelve months ending June 30, 2023, was an impressive $49.7 million.

Selling and Marketing expenses as a percentage of total revenue have trended lower as revenue has increased; its Selling and Marketing efficiency multiple rose to 0.9x in the most recent reporting period.

The firm currently plans to pay no dividends and to retain future earnings, if any, for reinvestment back into the firm’s growth initiatives and working capital requirements.

KVYO’s recent capital spending history indicates it has spent moderately on capital expenditures as a percentage of its operating cash flow.

The company’s Rule of 40 results have been excellent, with strong revenue growth and a small amount of operating profit contributing to a high figure for this metric.

The market opportunity for marketing automation is large and expected to grow at a moderately strong growth rate in the coming years, so the firm enjoys positive industry growth dynamics in its favor.

Goldman Sachs is the lead underwriter, and the eight IPOs led by the firm over the last 12-month period have generated an average return of 14.1% since their IPO. This is a mid-tier performance for all major underwriters during the period.

Business risks to the company’s outlook as a public company include the potential for other online marketing firms to bundle similar services and undercut Klaviyo on pricing.

According to venture capital database Pitchbook, KVYO’s most recent private funding round, which Shopify led, valued the company at $9.5 billion post-money.

So, it is likely management will seek a meaningful premium to this valuation in its public offering.

In short, Klaviyo appears to be a highly capital-efficient growth company that is already generating profits and free cash flow.

I’ll provide a final opinion when we learn more about the Klaviyo, Inc. IPO’s pricing and valuation assumptions.

Expected IPO Pricing Date: To be announced.

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)