vchal/iStock via Getty Images

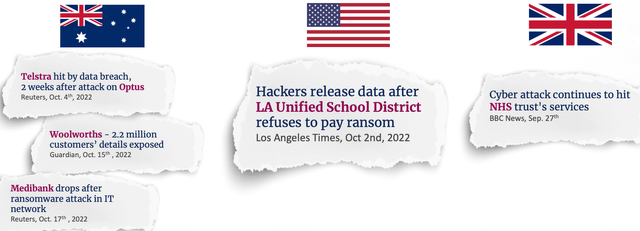

Global Cybersecurity attacks have risen by an eye-watering 32% year over year as the adoption of technology has accelerated since the pandemic. More recently, the LA Unified School District was hit with a ransomware attack while the UK’s NHS (Hospitals) was hit with a services attack.

Cybersecurity Attacks (Check Point Research)

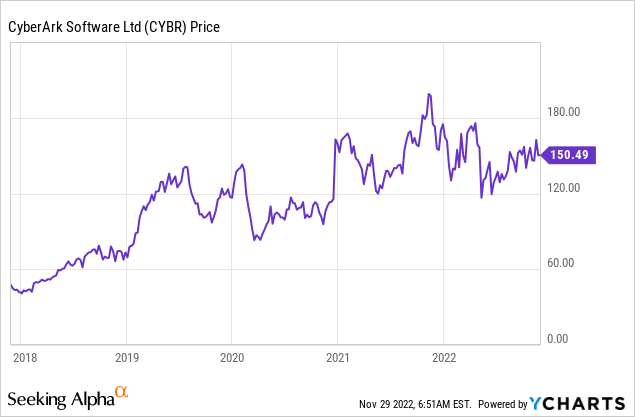

The need for cybersecurity tools and protection has never been greater. Therefore it is no surprise that the cybersecurity industry was valued at $139 billion in 2021 and is projected to grow at a solid 13.4% compounded annual growth rate, reaching a value of $376 billion by 2029. CyberArk (NASDAQ:CYBR) is poised to benefit from this growth trend as a leader in Access management. The company recently reported solid financial results as it beat both revenue and earnings estimates. In this post, I’m going to break down the company’s business model, financials, and valuation, let’s dive in.

Secure Business Model

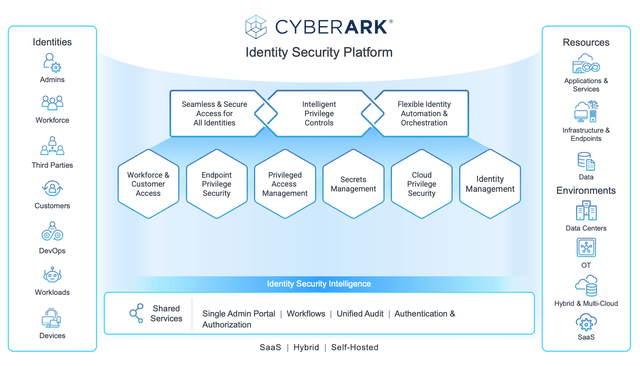

CyberArk Software provides a “modern approach” to identity security which is centered around the concept of “Zero Trust”. The idea of this is to only give users access to the applications they need and nothing else. This may seem like common sense but traditional IT networks are set up in such a way that users are “trusted” with all access. This is dangerous as it means if a hacker gains access to a corporate network via a harmless application, he could then move “laterally” to finance and all other applications to exploit the system or do a ransomware attack. A “Zero Trust” architecture helps to prevent this by only giving “least privileged access”.

CyberArk Platform (Q3,22 report)

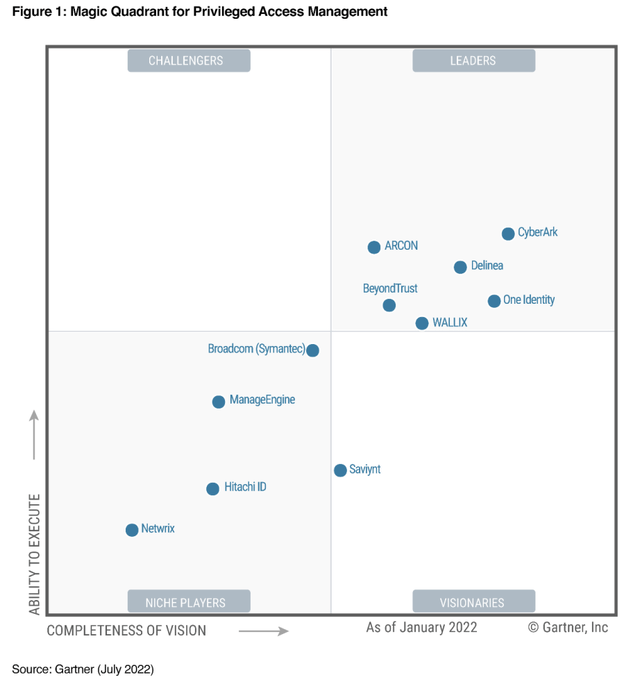

CyberArk is a Gartner Magic Quadrant leader in the world of “Privileged Access Management”. The hybrid/remote working environment has strengthened the need for this kind of security and thus the company is poised to benefit from growth in this sector.

Magic Quadrant Leader (Gartner)

Strong Third Quarter Financials

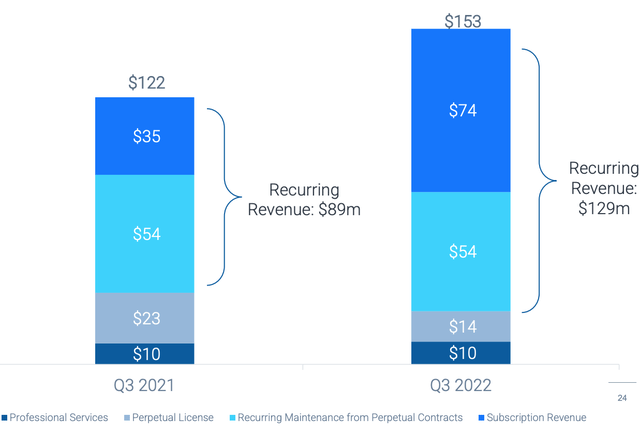

CyberArk software reported strong financial results for the third quarter of 2022. Revenue was $152.67 million which increased by 26% year over year and beat analyst expectations by $1.78 million. This solid growth was despite $2 million foreign exchange headwind due to the strong dollar which impacted international revenue. On an Adjusted basis, revenue increased by a rapid 35% year over year.

Breaking revenue down by segment, Subscription revenue popped by an outstanding 110% year over year to $74.2 million. This type of revenue now makes up 49% of the total and is a testament to the business’s move to a subscription-based business model. This is my favorite type of revenue model as it locks in consistent revenue while enabling easy upsells and cross-sells, which are positive dynamics the company has been seeing so far.

Perpetual license revenue did decline from $23 million to $13.8 million, which was expected as more customers switched to the subscription-based model. Maintenance and professional services revenue was flat year over year at $64.6 million. This doesn’t worry me too much as that is a lower margin portion of the business, but ideally, I would still like to be seeing some growth.

Revenue by type (Q3,22 report)

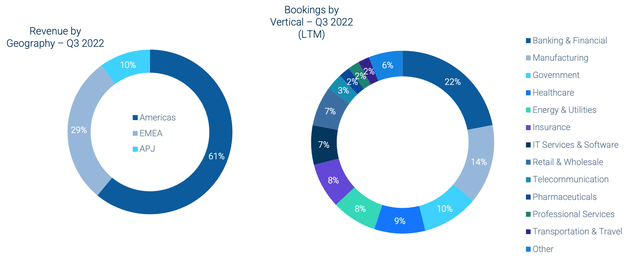

Recurring revenue grew by 44% year over year to $128.5 million, which made up 84% of total revenue. A greater portion of recurring revenue is a positive sign as it helps with consistency, forecasts, and the aforementioned upsells. By region, CyberArk is fairly diversified with 61% of its revenue from the Americas region which increased by 37% year over year. this was followed by the EMEA region which makes up 29% of total revenue or $43 million and grew by 10% year over year. It should be noted that the EMEA revenue was impacted by a $2 million FX headwind, due to the strong dollar mentioned prior. The APJ region made up 10% of revenue or $15.5 million and grew by 13% year over year. CyberArk is also extremely diversified across industry verticals as you can see from the right-side pie chart below. Its largest sector is Banking & Financials (22% of Bookings) which is a fairly stable industry. This is followed by Manufacturing at 14% and Government at 10% of Bookings.

Recurring Revenue by Geography (Q3,22 report)

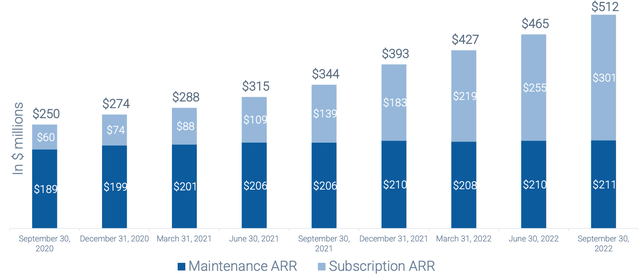

Annual Recurring Revenue [ARR] is a popular “north star” metric used by many SaaS companies. In this case, ARR increased to $512 million, up a blistering 49% year over year. The company has gradually grown “upmarket” with close to 1,200 customers with over $100k in ARR, up 50% year over year. This is a positive sign as larger customers tend to be more sticky and also are easier to manage from an operational perspective than multiple smaller customers. In simple terms, it’s easier to keep 1,200 people happy than 100,000 people.

ARR (Q3,22 report)

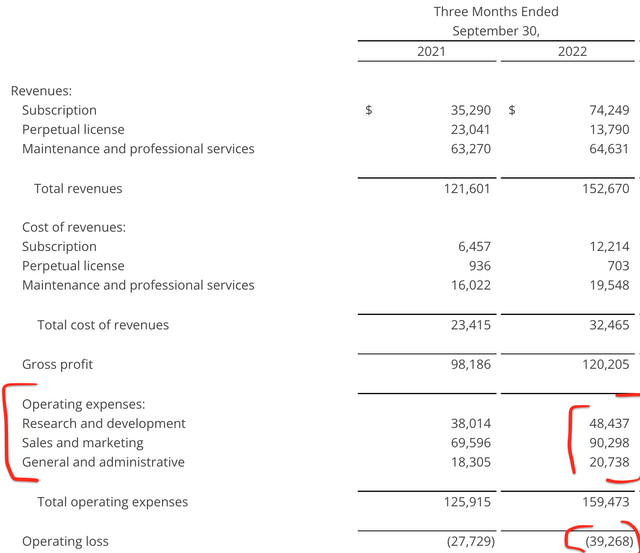

Onto profitability and expenses, the company reported $126 million in Gross profit at an 83% gross margin which was only down 1% from the prior year.

Earnings per share was a negative $0.80 which beat analyst estimates by $0.09, despite declining from the negative $0.73 reported in the prior year. This decline in earnings was the result of an eye-watering increase in operating expenses which rose by 27% year over year to $130 million. This may seem terrible at first glance but management blamed the transition to a subscription model in its Q3,22 earnings call. If I “pop the hood” on the expenses I can see there was a ~$10 million in R&D expenses which I don’t deem to be an issue, as the company must continually invest in innovation to stay ahead. The second major cost item was Sales and Marketing expenses which increased by 30% year over year to $90.3 million. This was followed by General and Administrative expenses which increased by 13% year over year to $20.7 million. Over time I would like to see S&M and G&A expenses decline as a portion of revenue as the company scales.

Operating Expenses (Q3,22 report)

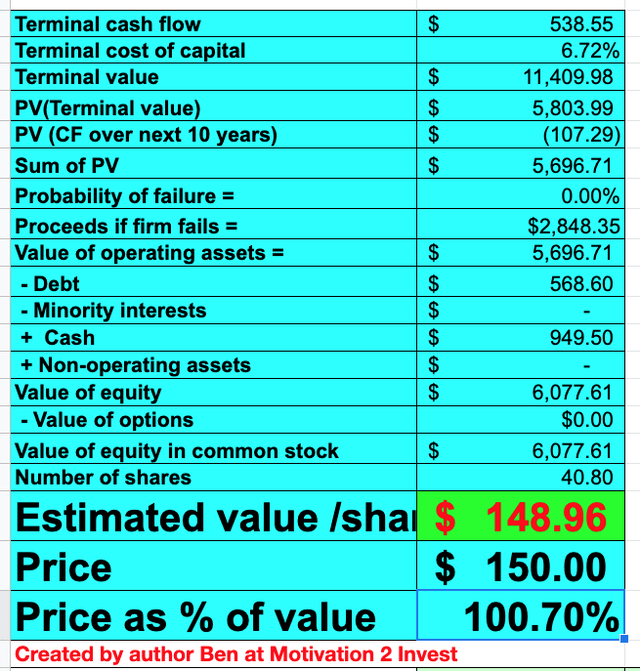

CyberArk has a strong balance sheet with $949.5 million in cash and short-term investments. In addition, the company reported $568.6 million in long-term debt.

Advanced Valuation

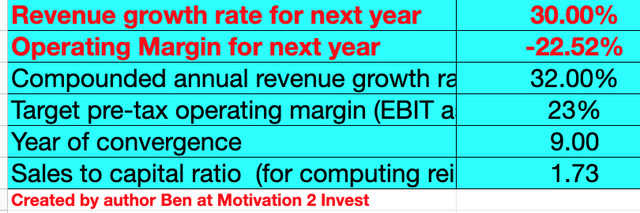

In order to value CyberArk, I have plugged the latest financial details into my discounted cash flow model. I have forecasted a 30% revenue growth rate for the next year which aligned with managements guidance for the full year of 2022 at the midpoint of its range. However, in years 2 to 5 I am forecasted growth to accelerate to 32% per year, as the economic situation is forecasted to improvement and FX headwinds reduce.

CyberArk stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized the company’s R&D expenses. In addition, I have forecasted the company to increase its operating margin to 23% over the next 9 years as the business scales to the average margin of the software industry. This is contingent on the company driving down its operating expenses as a portion of revenue.

CyberArk stock valuation 1 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $148.96 per share, thus the stock is “fairly valued” at the time of writing.

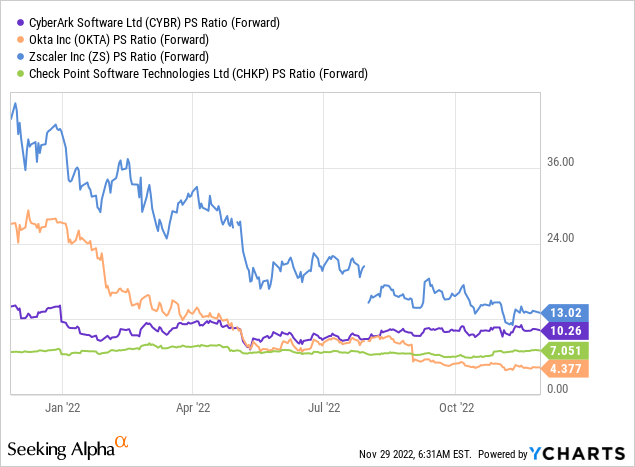

CyberArk also trades at a Price to Sales ratio = 10, which is fairly valued relative to its historic average. Relative to industry peers CyberArk trades at the mid to high end of the valuation multiples.

Risks

Longer Sales Cycles/Recession

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. CyberArk has recently seen its operating expenses rise substantially and thus will need to drive down this to become profitable. In addition, I would expect longer sales cycles and delayed spending by customers due to the macroeconomic environment.

Final Thoughts

CyberArk Software is a tremendous cybersecurity company and true leader in the world of Identity Access management. The company is executing its business model transition well and is poised to benefit from the secular growth in the industry. The only issue is the valuation, which isn’t exactly cheap at the time of writing; also its expenses have been rising, therefore I will label it as a “hold” for now.

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)