lerbank/iStock via Getty Images

Closed end funds have their perks. A packaged one-stop shop for buying into a sector gives investors an easier time than selecting from a myriad of investments. It also gives you something most ETFs do not. Leverage. Of course, you could be excused for forgetting what that dirty word meant in the last few years as nobody really cared. Unfortunately, the chickens are coming home to roost there and that means some distribution cuts for your favorite CEFs. We go over two today and tell you why we think they should be sold here.

Aberdeen Global Premier Properties Fund (NYSE:AWP) And CBRE Global Real Estate Income Fund (NYSE:IGR)

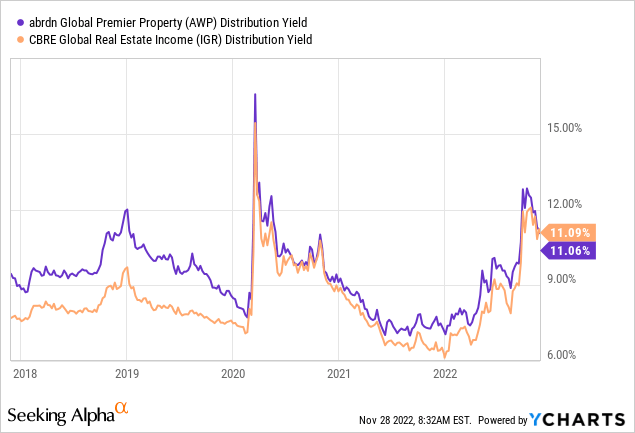

We have covered AWP and IGR previously. Both funds are extremely popular within the real estate investment sector. Together they have net assets of over $1.2 billion. Their main allure has always been their giant distribution yields. In the recent selloff their yields hit over 12%. There has been a notable bounce back in the prices of these funds and a consequent drop in yields, but they still are doling out very generous amounts of distributions relative to other investments.

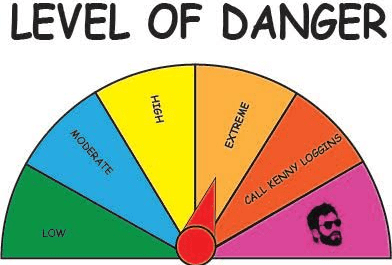

Of course, as anyone who has spent any amount of time in the market knows, distributions don’t represent what you actually end up making. We go over the structure and problems common to these funds and give you our Kenny Loggins’ scale rating for the distribution safety.

Growth Orientation Creates High Risks

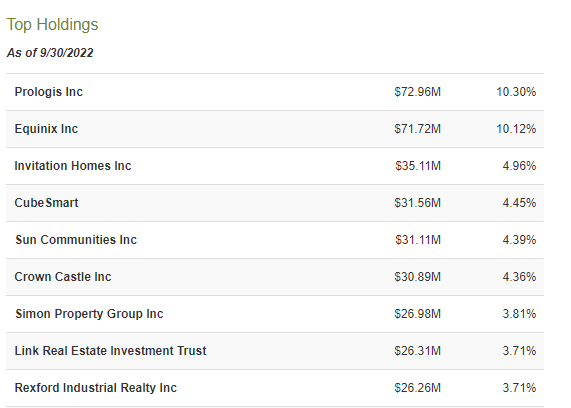

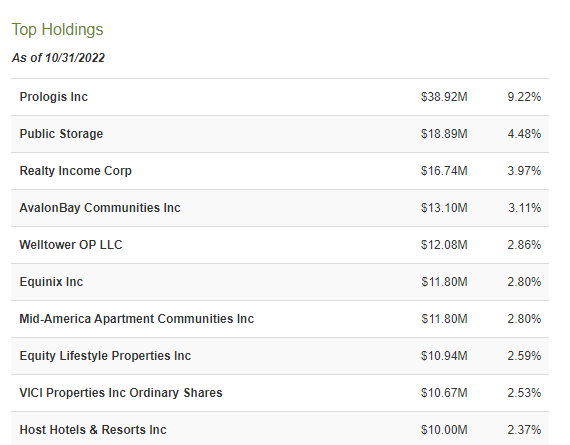

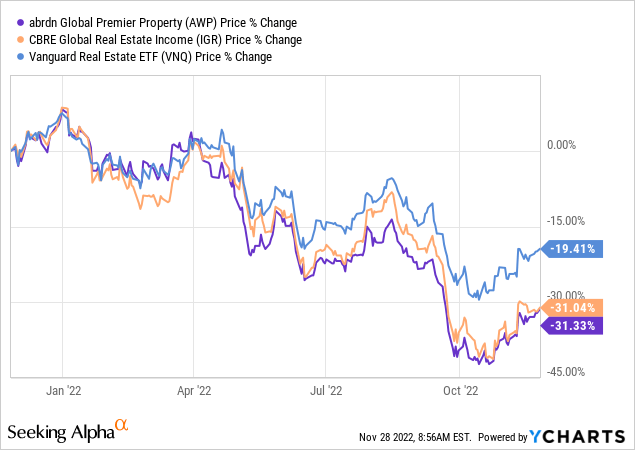

IGR’s top 10 holdings account for nearly half of the fund’s net assets and are heavily concentrated in names like Prologis, Inc. (PLD) and Equinix, Inc. (EQIX).

CEF Connect-IGR

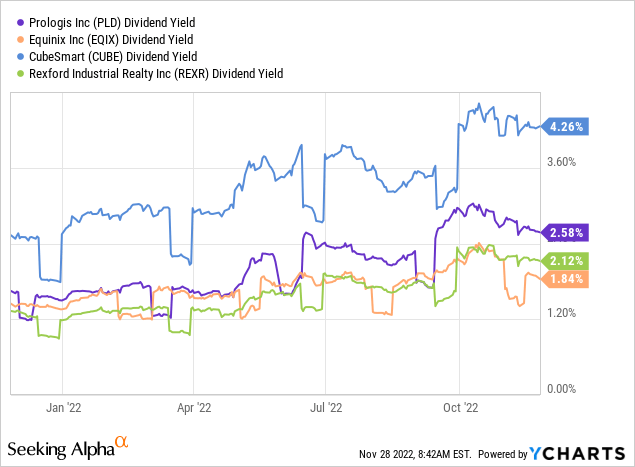

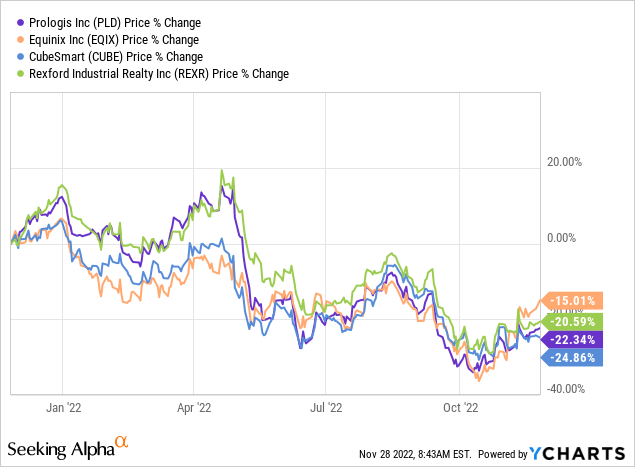

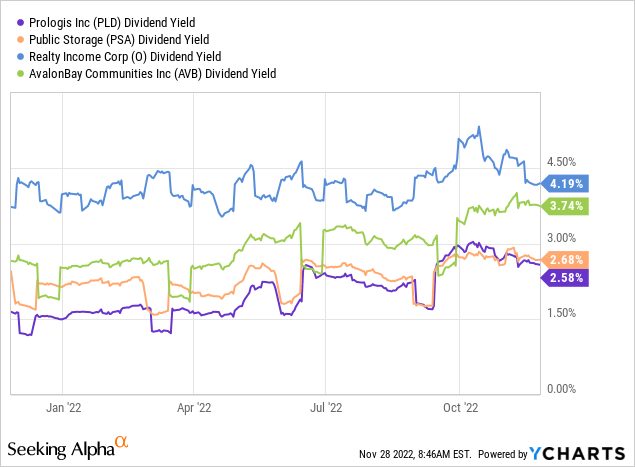

The underlying theme for these stocks and many further down the list like CubeSmart (CUBE) and Rexford Industrial Space Realty, Inc. (REXR) is that they are all growth plays and offer very poor dividends of their own.

In fact, the four mentioned above, average a yield of just 2.7%. That 2.7% yield is the current number after these stocks have fallen about 20% in the last 12 months.

AWP also holds PLD as a top name.

CEF Connect-AWP

While its holdings have a slightly better average yield, they too average poorly.

Obviously, neither set comes even close to covering a third of the distribution yields of these funds.

Hence there is a heavy reliance on price expansion to fund the distribution from underlying assets. We believe that price expansion is going to be missing from the picture as we will see more valuation compression in all growth names. In fact, we expect value to continue to trounce growth over this cycle and we are likely in the second or third innings at this point.

Topdown Charts

Leverage Continues To Hurt

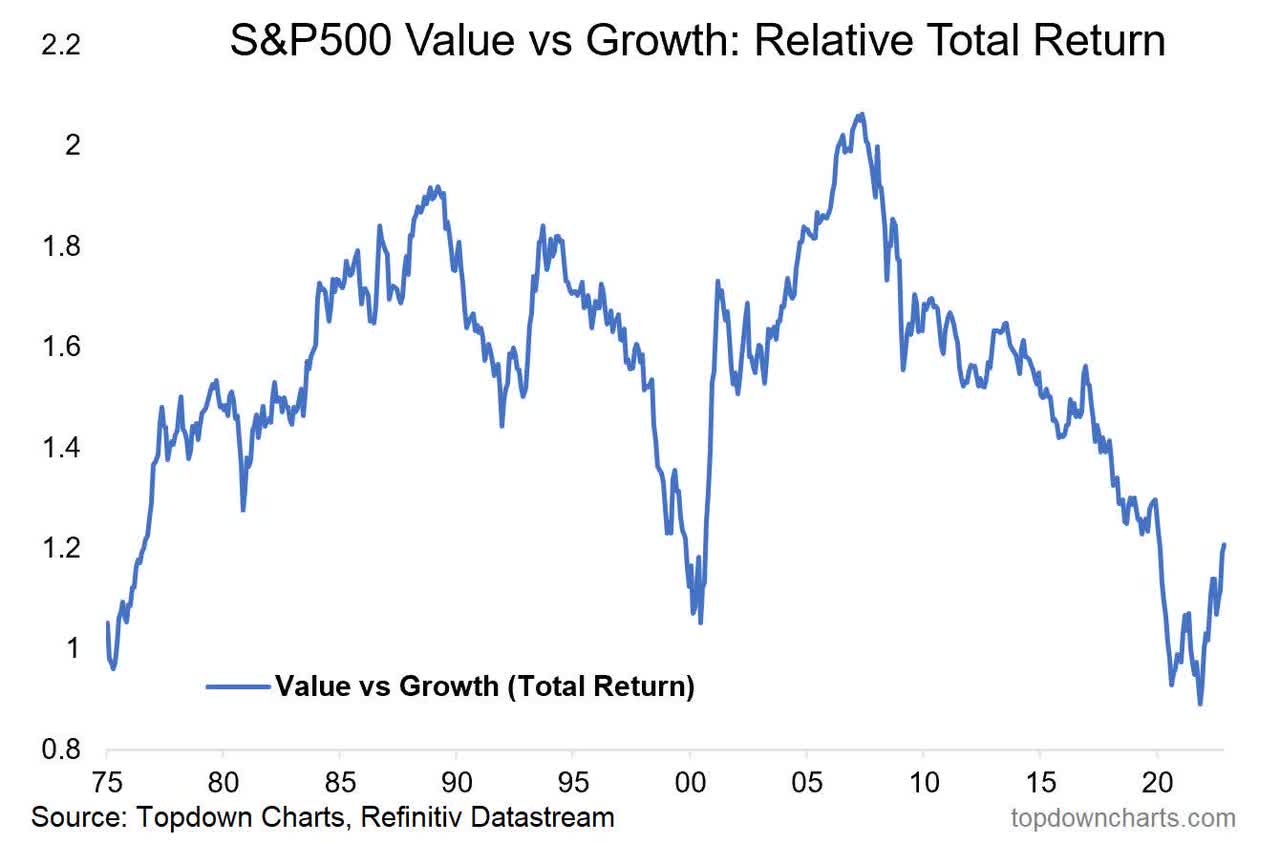

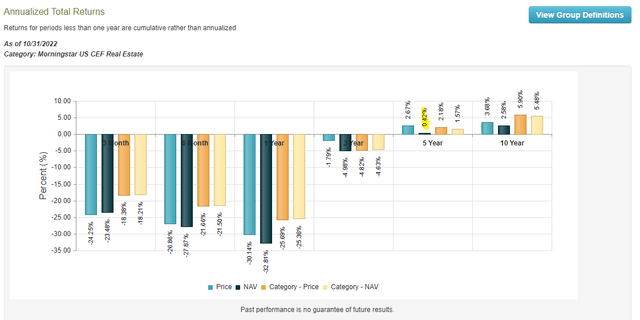

AWP and IGR have used modest amounts of leverage over the years to boost their returns. This has not been a big issue until recently. Leverage works both ways and the lag versus Vanguard Real Estate ETF (VNQ) has been notable in the last 12 months.

That graph of course shows only price and is not adjusted for distributions. We did that purposefully so investors could grasp just how much stock these funds are having to sell on the way down to fund those sweet distributions. After all, if the underlying yields don’t cover even a third of the paid distribution, the remaining must come by selling shares.

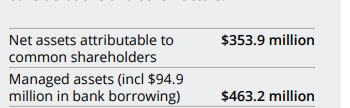

This experiment has gone unfettered in the market, thanks to leverage expense being modestly low in 2022. At present both funds continue to use leverage. AWP’s borrowings are about 27% of net assets.

AWP-Fact Sheet

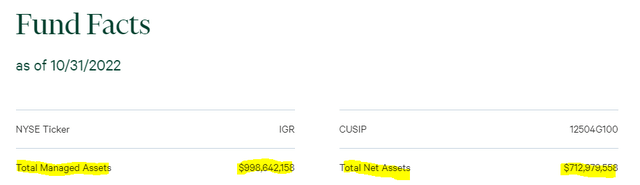

IGR’s borrowings are about 40% of net assets.

IGR-Fund Facts

For both these funds, interest costs have risen with a lag to the Federal Funds rate, but you could be forgiven for ignoring the absolute amounts paid. Come 2023, it will be a different ballgame. With risk free rates moving to perhaps 5%, the pain will be intense for these funds.

The Trust has access to a secured line of credit from BNYM for borrowing purposes. Borrowings under this arrangement bear interest at the Federal funds rate plus 75 basis points.

Source: IGR Semi-Annual Report

With effective rates on borrowing (close to 6% in 2023) exceeding almost every single underlying dividend yield, what do you think happens in the next year? The carry trade goes kaput, and we should see more liquidations further pressuring NAV.

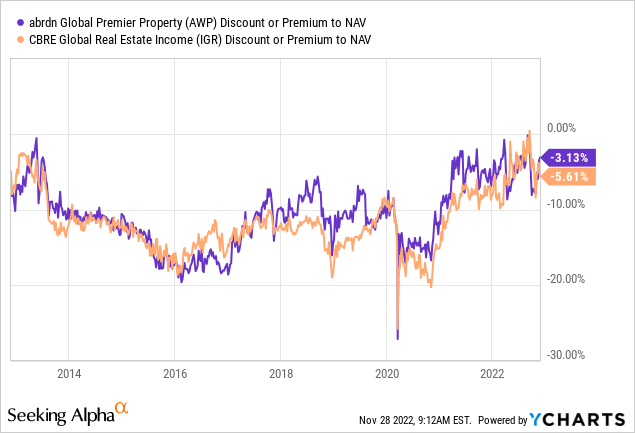

No Real Margin Of Safety

It would be one thing if these funds were at big discounts to NAV. Perhaps you would feel better knowing that you were getting a bargain in one manner that compensated you for the risks. Currently, both funds are priced to perfection and if we are correct about the cuts and they move to a 20% discount, it will play out exactly like the extremely poor returns on PIMCO funds played out.

Verdict

At some point, you have to ask yourself why you are buying or holding these funds. Is it for the distribution they don’t cover or really never have covered? Does that appeal to you? If the answer is that you like getting your money back, well then, we cannot help you.

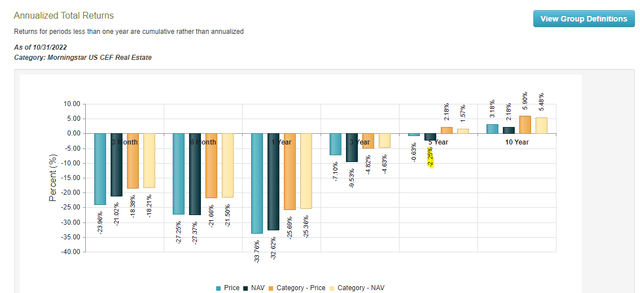

It certainly cannot be for these two funds long term performance. AWP produced total returns including distributions of negative 2.2% compounded over the last five years.

CEF Connect-AWP

IGR managed to poke its head above the flat line, but definitely did not deliver.

CEF Connect-IGR

If we did not get a great outcome during the last five years where the Federal Reserve was generally philanthropic, don’t expect better during the next five. Both distributions will be cut eventually and only the timeline remains in question. We are moving up the risk on our proprietary Kenny Loggins scale.

Kenny Loggins Scale

An “extreme” rating signifies a 50%-75% probability of a dividend cut in the next 12 months. We are maintaining IGR at a Sell rating, same as last time and now downgrading AWP to a Sell.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)