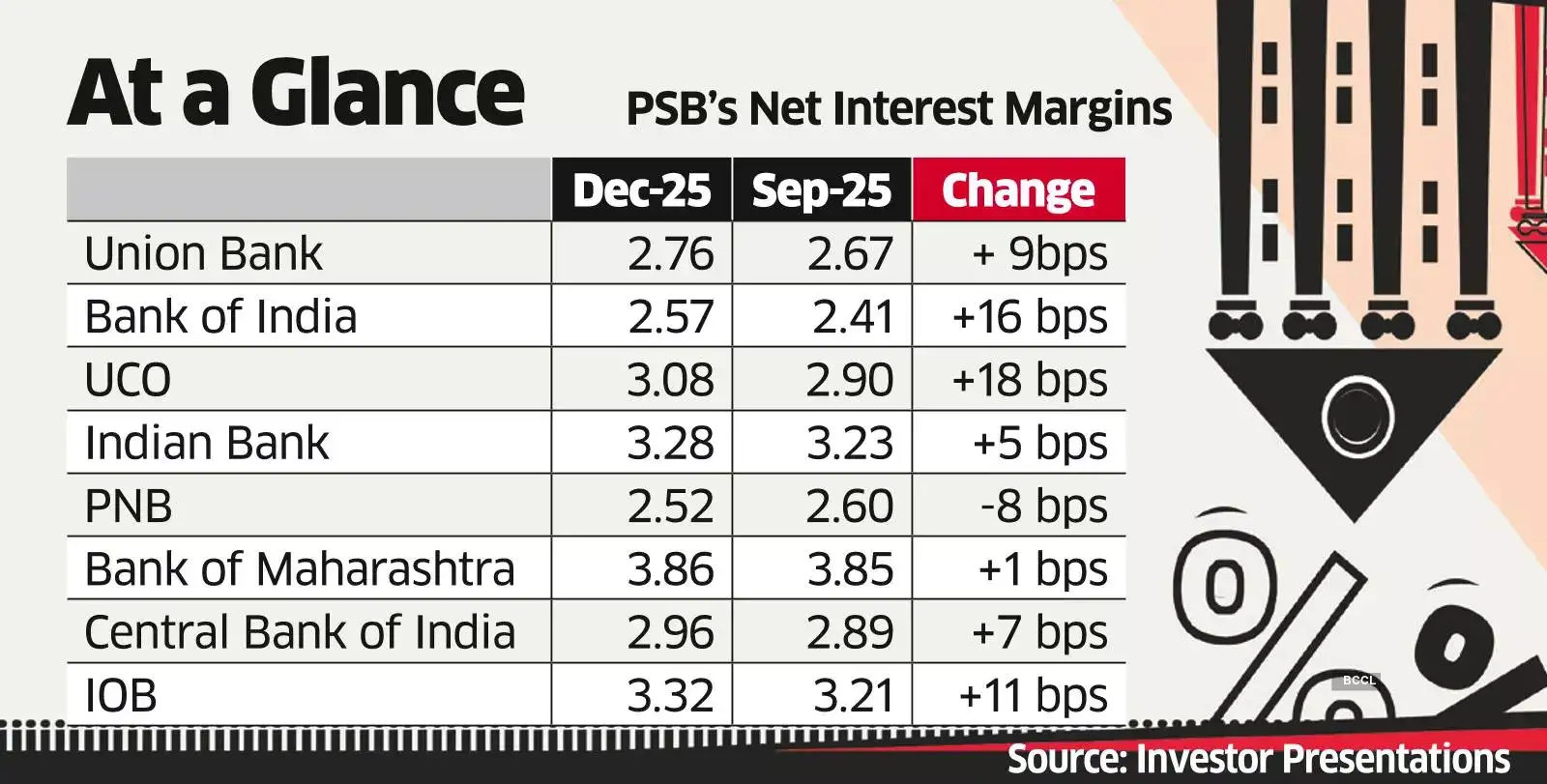

Seven out of eight public sector banks that released quarterly results so far held on to or improved margins from the previous three months, helping them maintain profitability despite a challenging macro environment.

Kolkata-based UCO Bank posted the biggest quarter-on-quarter improvement in NIM—up 18 basis points, or 0.18 percentage point—while Mumbai-headquartered Bank of India (BoI) was next with a 16-basis-point gain. NIM, a key matrix to measure a bank’s profitability, is the difference between the interest earned on loans and cost of funds.

BoI shed some loans from low-margin, higher-rated companies including a few government-owned ones, repriced bulk deposits at lower rates and continued growing its higher yielding retail loan portfolio to improve NIM, chief executive Rajneesh Karnatak said at an earnings conference.

The bank’s NIM improved to 2.57% in December 2025 from 2.41% in September.

Some banks like Mumbai-based Union Bank of India have focussed on reducing cost of funds by shedding bulk deposits.

Union Bank chief financial officer Avinash Prabhu told ET that the lender reduced close to Rs 33,000 crore of bulk deposits during the quarter, which helped it to protect NIM.“The idea is that the drop in cost of funds has to be higher than the drop in yield on advances due to the falling rates. This along with growth in the higher-yielding RAM (retail, agriculture and MSME) advances helped the bank improve margins compared to the quarter ended September,” Prabhu said.

Bulk deposits as a percentage of total deposits came down to 21% in December 2025 from 23% three months prior and 26% a year earlier. As a result, Union Bank’s NIM improved to 2.76% in December 2025 from 2.67% as of end-September.

Indian Bank chief executive Binod Kumar said the Chennai-based bank maintained its share of low-cost current and savings accounts during the quarter at 39%, which helped maintain NIM. “We also shed some low-yielding advances of top-rated companies both from the public and the private sector and increased the share of higher-yielding RAM advances, particularly from sectors like MSMEs which are higher yielding,” Kumar told ET.

Indian Bank sanctioned Rs 13,700 crore of loans to MSMEs during the quarter. Its NIM improved to 3.28% from 3.23% in September 2025.

Market leader State Bank of India, Bank of Baroda and Canara Bank have yet to report third-quarter results. Punjab National Bank is the only state-run bank that so far posted a lower NIM at 2.52% compared with 2.60% three months prior.

Analysts and bankers said continued repricing of term deposits well into the next fiscal year will support bank margins, especially in the next fiscal year ending March 2027. “One needs to watch out whether the RBI reduces rates further in its next policy review. But, generally term deposit rates will continue to come down which means bank NIMs will improve next fiscal,” said Motilal Oswal analyst Nitin Aggarwal.

Bankers said deposit repricing will continue in the current quarter and the first quarter of the next fiscal year. Kumar from Indian Bank said he expects 18% of his bank’s deposits to reprice in the current quarter and a further 17% in the next quarter, supporting its NIM.

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)