HONG KONG: Asian stocks rose on Tuesday (Jul 1) amid optimism countries will strike US trade deals, though Tokyo’s Nikkei sank after Donald Trump threatened to impose a fresh tariff rate on Japan as he hit out at the country over rice and autos.

The dollar also extended losses as investors grow increasingly confident the Federal Reserve will cut interest rates at least twice this year, with keen interest in US jobs data due this week.

Investors are also keeping an eye on the progress of the US president’s signature multi-trillion-dollar tax-cutting bill, which is being debated in the Senate.

While few agreements have been reached as the White House’s Jul 9 deadline approaches, equity markets are enjoying a healthy run-up on expectations that breakthroughs will be made or the timeline will be pushed back.

Comments from Trump and some of his top officials suggesting there could be some wiggle room have added to the positive mood, with National Economic Council director Kevin Hassett telling CNBC a “double digit” number of pacts, including frameworks, were near.

News that Canada had rescinded a tax affecting US tech firms, which had prompted Trump to halt trade talks, and restarted negotiations fuelled optimism that other governments would make deals.

All three main indexes on Wall Street rose again Monday, with the S&P 500 and Nasdaq each pushing to another record high, providing a springboard for Asia.

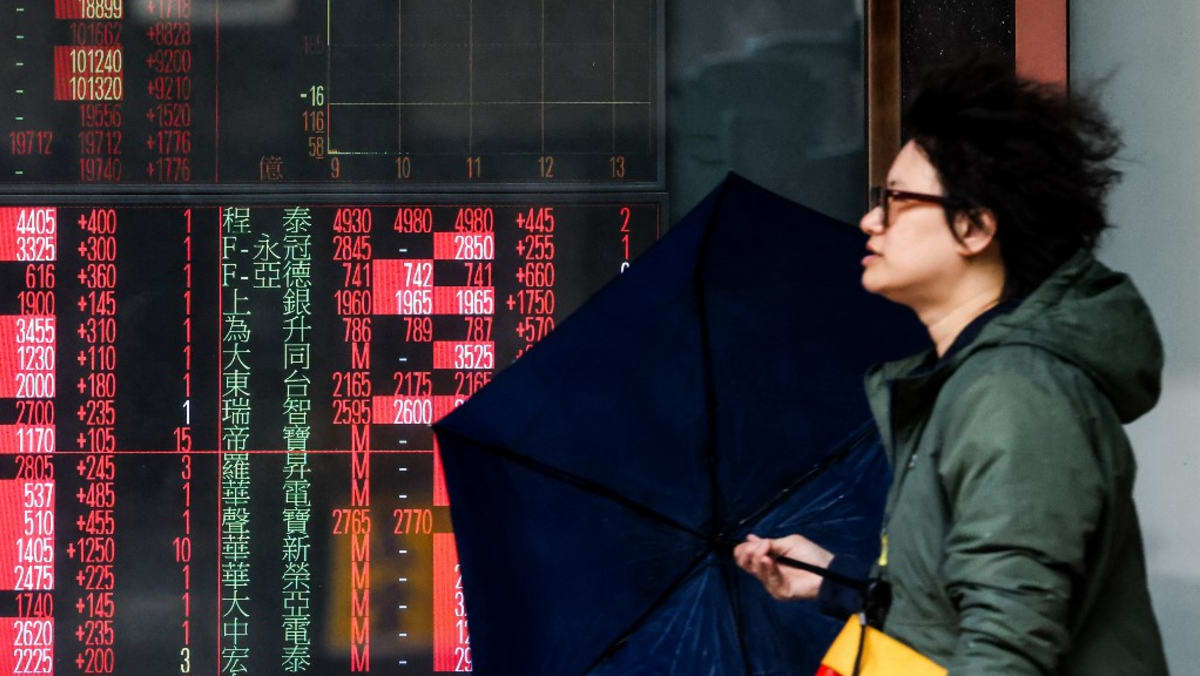

Shanghai, Sydney, Singapore, Seoul and Taipei led healthy gains across the region.

However, Tokyo, which has enjoyed a strong run in recent weeks, sank 1 per cent after Trump threatened to impose a fresh levy on Japan over a row about the country accepting US rice exports.

“I have great respect for Japan, they won’t take our RICE, and yet they have a massive rice shortage,” Trump wrote on his Truth Social platform.

“In other words, we’ll just be sending them a letter, and we love having them as a Trading Partner for many years to come,” he added.

(Except for the headline, this story has not been edited by PostX News and is published from a syndicated feed.)